Mitmetes finantsblogides on täna ära toodud Shanghai 7 päeva

Interbank Lending Rate ehk SHIBOR, mis on paari päevaga ca 2.5% pealt 7.4% peale tõusnud.

Siinkohal ei tahaks küll liigset pessimismi külvata, aga kui ühele ja samale graafikule lisada ka Shanghai Composite ja SHIBOR, siis on selgelt näga, millest juttu on (valge joon tähistab SHIBORi).

CNBC vahendusel Reutersi uudis sellest, kuidas Föderaalreserv viis läbi paar muutust raamatupidamise meetodites, eesmärgiga kanda enda potentsiaalsed kaotused (erinevate võlakirjade hoidmisest) sisuliselt üle rahandusministeeriumile.

Concerns that the Federal Reserve could suffer losses on its massive bond holdings may have driven the central bank to adopt a little-noticed accounting change with huge implications: it makes insolvency much less likely.

The significant shift was tucked quietly into the Fed's weekly report on its balance sheet and phrased in such technical terms that it was not even reported by financial media when originally announced on Jan. 6.

"Any future losses the Fed may incur will now show up as a negative liability as opposed to a reduction in Fed capital, thereby making a negative capital situation technically impossible," said Brian Smedley, a rates strategist at Bank of America-Merrill Lynch and a former New York Fed staffer.

Võttes arvesse, et Föderaalreserv on suurim USA võlakirjade omaja, on viimasel ajal olnud teemaks ka see, kas Fed võib tehniliselt minna pankrotti (võttes loomulikult arvesse ka seda, et Fed võib vajadusel raha juurde toota nii palju kui ise tahab).

Siin Casey Researchi artiklis analüüsib Terry Coxon intressimäärade tõusust tulenevaid võimalusi Fedi tehniliseks pankrotiks. Muudatused raamatupidamise meetodites on selle sündmuse tõenäosuse sisuliselt nullini viinud.

Kas on olemas ka mingit adekvaatset põhjust miks SHIBOR spikeb?

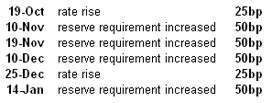

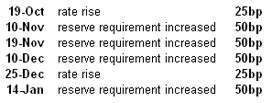

Ma ei usu seda. RRR tõuse on tulnud tihedalt, siis pole nii ekstreemset reaktsiooni järgnenud. Siin peab olema mingi muu põhjus.

China tightens policy & signals yuan flexibilityEvery two weeks, on average. That’s how often China is introducing some form of tightening at the moment. The People’s Bank has just increased the reserve ratio again, by 50 basis points, or a half of one percentage point. This increases the amount of cash banks have to keep with the central bank, thus reducing the amount available to lend. Our calculations suggest rural and small-medium sized banks will have to keep 15.5 per cent of their deposits with the central bank, while larger banks will need to keep 19 per cent.

Tundub, et siiski viimane RRR tõstmine, mis hakkas kehtima lõppeva nädala neljapäevast, tekitas Hiina pankades korraliku likviidsusprobleemi, millest tulenevalt ka SHIBOR taevasse lendas. Miks muidu pidi Hiina keskpank

reverse repot tegema, et kahte Hiina pangandusgiganti reservinõude rahuldamiseks toetada. Ühtegi paremat seletust ma ei leia. (

TradingMarkets.com link):

Chinese central bank, the People's Bank of China (PBC), conducted on Thursday RMB50 billion (US$7.59 billion) reverse repos to help some lenders pay for the Thursday-effective new required reverse ratio, reported China Securities Journal citing sources on Friday.

According to the report, PBC funded two of China's five bank giants, including Industrial and Commercial Bank of China (SSE:601398, SEHK:1398), Agricultural Bank of China (SSE:601288, SEHK:1288), Bank of China (SSE:601988, SEHK:3988), China Construction Bank (SSE:601939, SEHK:0939) and Bank of Communications (SSE:601328, SEHK:3328).

In fact, the Chinese central bank has suspended all its open market operations in this week to ease up lenders' hardness in preparing cash for the RRR payment.

Publicized data shows that PBC out flowed net RMB249 billion yuan moneys into local financial sector in this week.

Previously on January 14, PBoC announced that it would lead up lenders' RRR by 0.5 per cent since Thursday, meaning a historical high 19 per cent required reserve for outsized national banks hence.

Hiina uus aasta algab 3 veebruaril. Ma arvan, et SHIBOR spikeb osaliselt year end fix´i tõttu. See on tüüpiline, et aastalõppude ümber on mingid imelikud ja ootamatud likviidsusevajadused mis aasta vahetudes kaovad.

Bloomberg (6. jaanuar):

"While the seven-day repo rate has dropped 320 basis points, or 3.20 percentage points, from a three-year high of 6.34 percent in three days, it may rebound before the five-day Lunar New Year holiday that starts Feb. 2, said Zhou Yan, a fixed- income analyst in Shanghai at Bank of Communications Ltd."

“The pre-holiday cash hoarding by financial institutions and the rising inflation expectations will cause a resurgence in money-market rates. If banks extend more lending than targeted in January, the central bank may raise reserve ratios for major banks before the holidays, which will push up the repo rate even higher."

Ehk kõikide eelduste kohaselt on põhjuseks "reserve ratio" tõstmine ning aastavahetus.

Reedel mainitud probleem ostus piisavalt suureks, et eile (esmaspäeval) otsustas PPoC taastada likviidsust – keskpank süstis süsteemi CNY300 miljardit läbi “reverse repo’de,” mis hõlbustab pankadevahelist laenamist (langetab SHIBORi). Võttes arvesse seda, et Hiina keskpanga eesmärk on majanduse “jahutamine,” kas läbi repo’de või reservmäärade tõstmise, on tegemist huvitava uudisega. Teisisõnu päris normaalseks reedel juhtunut kindlasti liigitada ei saa.